The great AV sharing arms race

While many across the Northern Hemisphere have been enjoying the annual summer lull, those in the business of personal mobility have been working unabated. Like the cold war superpowers of old, bold statements and bravado have raised the stakes as tech and automotive giants from Silicon Valley and Detroit draw the battle lines for the future of the $100 billion* mobility services industry.

As has always been the case, the winner of an arms race is not just the side which can make their arsenals bigger, more quickly and more deadly. The winner is also the party who can convince the other they have the upper hand. In the mobility space, clear battle lines are beginning to settle on three main grounds: ride sharing (a mix of car pooling & car sharing) electric vehicles and autonomous vehicles.

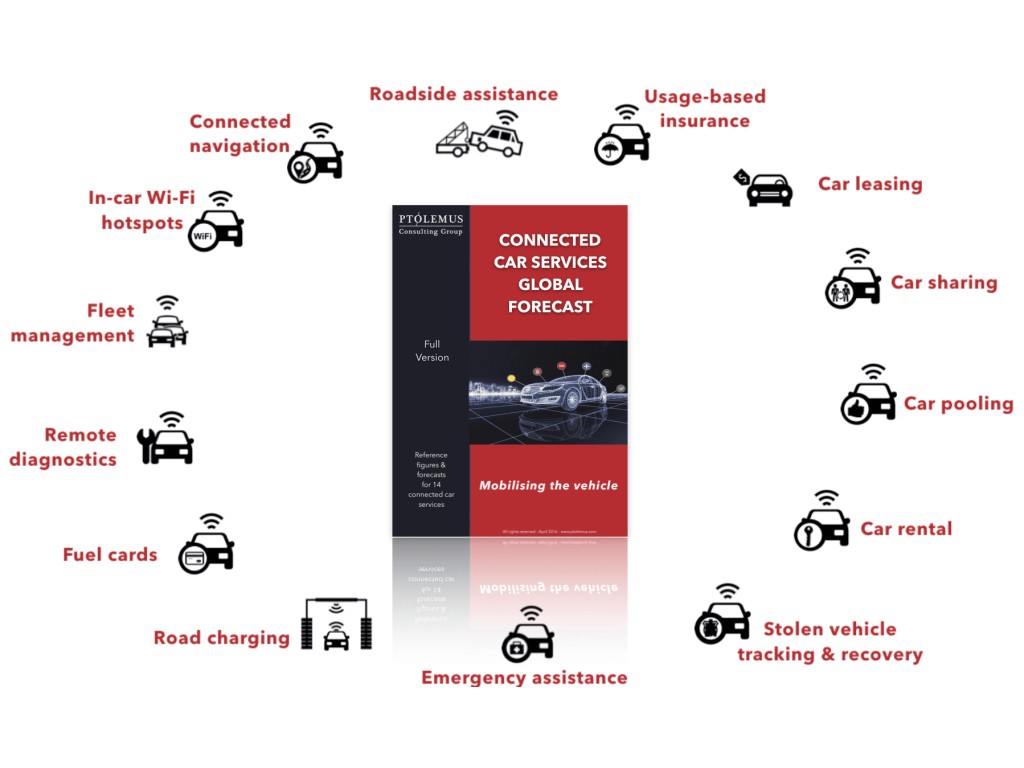

In the case of the technologies that underpin both autonomy and electrification, OEMs are under enormous pressure to deliver. First on the visions of a luxury, clean, hands-free driving experience sold by excitable marketeers and CEOs, but also on the delivery model and the implications it can and will have for the wider mobility services market. Chief among these is the growth of car sharing and car pooling, often referred to singularly as ride sharing. As we explore in our Global Connected Mobility Forecast, revenues from car pooling alone are predicted to reach $30 billion by 2020, driven by the unrelenting growth of ride hailing apps such as Uber, Didi Chuxing, Lyft, Grab and Ola. Alongside this, there have been a recent series of substantial investments and activities from carmakers in new and existing car sharing platforms.

OEMs are not new to the car sharing game. Daimler, BMW, Ford, GM, Toyota, Volkswagen and Volvo all have existing consumer schemes, either provided directly or in partnership with a third party. In the last week alone, BMW announced that its DriveNow brand had reached 20,000 users in London. In total, DriveNow has over 600,000 registered users worldwide. An impressive number given the scheme has existed for just five years, but still small fry compared to Daimler’s 1.9 million users through the Car2Go brand. Other OEMs have been falling over themselves to get in on the act. Only last month it was disclosed that Renault would launch a brand new car sharing service, Renault Mobility, in October, with the explicit aim of making a Renault “easily accessible and available at any time.”

Renault is also involved in the first trial of robot parking in Singapore lead by MIT-spinoff Nutonomy, using their electric car the Zoe. In fact all the brands mentioned so far have made parallel announcement in electrification of their fleet. Volvo’s Board announced hybrid electric cars will represent 10% of global sales by 2017 with an all-electric model expected in 2019. BMW mentioned a complete reorganisation of its R&D department to focus on creating an electric autonomous vehicle by 2021. At the same time, Daimler is expected to launch 2 SUV and 2 sedan fully electric models in September under a sub-brand, which is as yet undisclosed.

As a core element of its Master Plan: Part Deux, Tesla announced that it would aim to launch a peer-to-peer car sharing platform alongside a fully autonomous vehicle. By fully utilising the driverless technology Tesla is fast developing, owners will be able to share their vehicles when not in use, thus generating additional income and “dramatically” lowering the true cost of ownership. Not in the Master Plan was Tesla’s less publicised intention to provide insurance services directly to their drivers.

Shortly after, Ford boasted of their target to develop a high-volume, fully autonomous SAE level 4-capable vehicle by 2021, explicitly designed for use on ride sharing platforms. BMW has made a similar commitment with the same five-year target. This was accompanied by a low-key $24 million funding round into India’s largest car sharing company, Zoomcar, which was led by Ford. In less than three years, Zoomcar claims to have attracted more than 1 million users across India. If true, this would push it ahead of Zipcar as the second largest B2C scheme in the world.

Building on its highly successful partnership with car sharing provider Sunfleet in Sweden (which has over 60,000 subscribers), Volvo has joined forces with the world’s most valuable start up, Uber to jointly deliver autonomous vehicles for use in ride hailing. It is tempting to say that Uber is deriving greater value from this relationship and that Volvo is little more than a contract manufacturer. However, one look at Uber’s rate of growth (see table below) reveals that the marketing value to be had from vehicle exposure alone could be indeed worthwhile for the OEM. Nonetheless, Uber is not the only tech giant focused on providing a mass scale, autonomous ride sharing platform, or indeed the biggest.

Ford’s planned autonomous vehicle for ride sharing will be an electric hybrid model

As we reported earlier this year, Google has also entered the ride sharing space with the full commercial launch of its Waze carpool app. Initially trialled with a select group of employers, Waze carpool is now available to all Waze users in the San Francisco area. It is well known that Google has been busy developing its own (fully electric) driverless car for some time now. If the world’s second most valuable company is able to one day combine the two Uber may suddenly become yesterday’s news. As technology companies become manufacturers and manufacturers become technology companies, both parties will have to beat the other at their own game.

Table: Uber’s relentless rise:

June 2010 1 ride

June 2011 64,479 rides

June 2012 1,000,000 rides

June 2013 10,470,185 rides

June 2014 65,876,482 rides

June 2015 376,744,868 rides

December 2015 1,000,000,000 rides

June 2016 2,000,000,000 rides