“Have you tried turning it off and on again?”

In the future world of driverless cars, road side assistance will have to become more like IT support

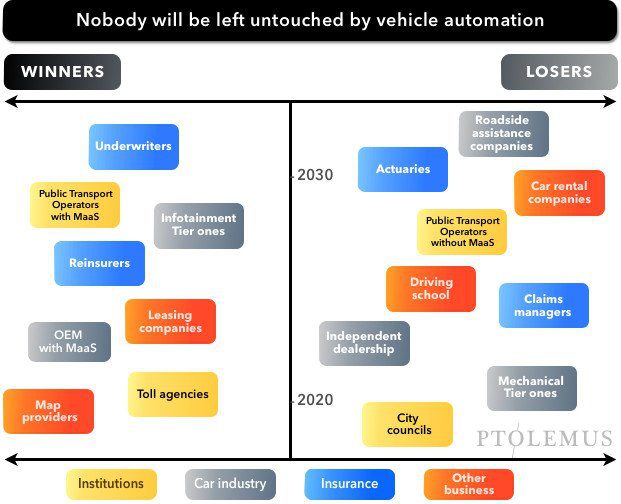

Wherever you stand in the connected vehicle value chain, your sector features on the Vehicle Automation Winner or Loser graph illustrated below (this is a sample). Yet, what really matters is not where you stand at any one stage in the future, but each company journey from today.

For example, by 2050, since we predict a dramatic fall in crash occurrences, there will be less need for towing and Roadside Assistance (RSA) services, yet that doesn’t mean the whole breakdown assistance and repair market is in peril. In fact a number of conflicting factors will come into play.

Yes, it will become more difficult to get locked out of the car or run out of fuel for example. Crashes are expected to come down – requiring fewer tows – but it won’t affect breakdown assistance due to flat tyres, batteries or being stuck in a ditch. (OK, Autonomous vehicles should at least avoid the last one.)

The electrification of the autonomous fleet that we are promised will impact reliability in the medium term because there are fewer moving parts. However, the first versions of these vehicles have been rushed through the line to beat the competition and, as a result, the ones on the road today are less than perfectly reliable.

In fact, in conversation with a large roadside assistance providers, it was confirmed specific models of cars are 4 time less reliable now that they are hybrid and have ADAS features installed? Why? More complex electronics increases the risk that a single fault will affect the whole car.

As vehicles become increasingly more complex and more specialised, technical knowledge will be needed. In the short/med term, while the industry adjusts to these new techniques, it will elongate the amount of time it takes to repair a vehicle. With ADAS sensors for example, once the repair has been ordered and the part found, it needs to be re-integrated into the car, not just re-installed. For windshields, this includes the need for recalibration. That alone adds around €200 to each windscreen repair cost, if the workshop has the right licence, equipment and trained staff.

This is where communication between the different parties will create the most savings. Assistance and repair companies we talked to insisted on the need for an integrated solution between the fault or crash detection, repair, assistance and claims management.

Roadside assistance will not disappear anytime soon, but companies will need to change dramatically to adapt to the lower frequency, higher cost and specification of the repair and progressive change in the nature of the car parc. To meet the needs of AVs, assistance services may become closer to “technical support”.

With the shift towards shared mobility, the key will be to integrated further along the value chain with the leasers and OEMs. First, on the value proposition and service delivery side, but then also on the ADAS and diagnostic data side.

As more of the parc becomes fleet, the RSA players will need to position themselves quickly towards who ever the mobility providers is. The range is wide from private taxi company to internet giant, city council or – of course – the OEMs. In each case however, servicing a fleet and assisting cars and passengers on the road may not be a core function of these service providers and RSA companies will have a role to play.

A full quantitative analysis of the impact of AVs on the risk sector as well global forecast of their adoption can be found here